China's Battery Giants Accelerate Global Expansion and Innovation

Date:2025-07-07

In a flurry of industry moves, China's leading battery and energy storage companies—including EVE Energy, CATL, SVOLT, Sunwoda, and Gotion High-tech—have recently announced significant milestones that underscore their ambitions in both domestic and international markets.

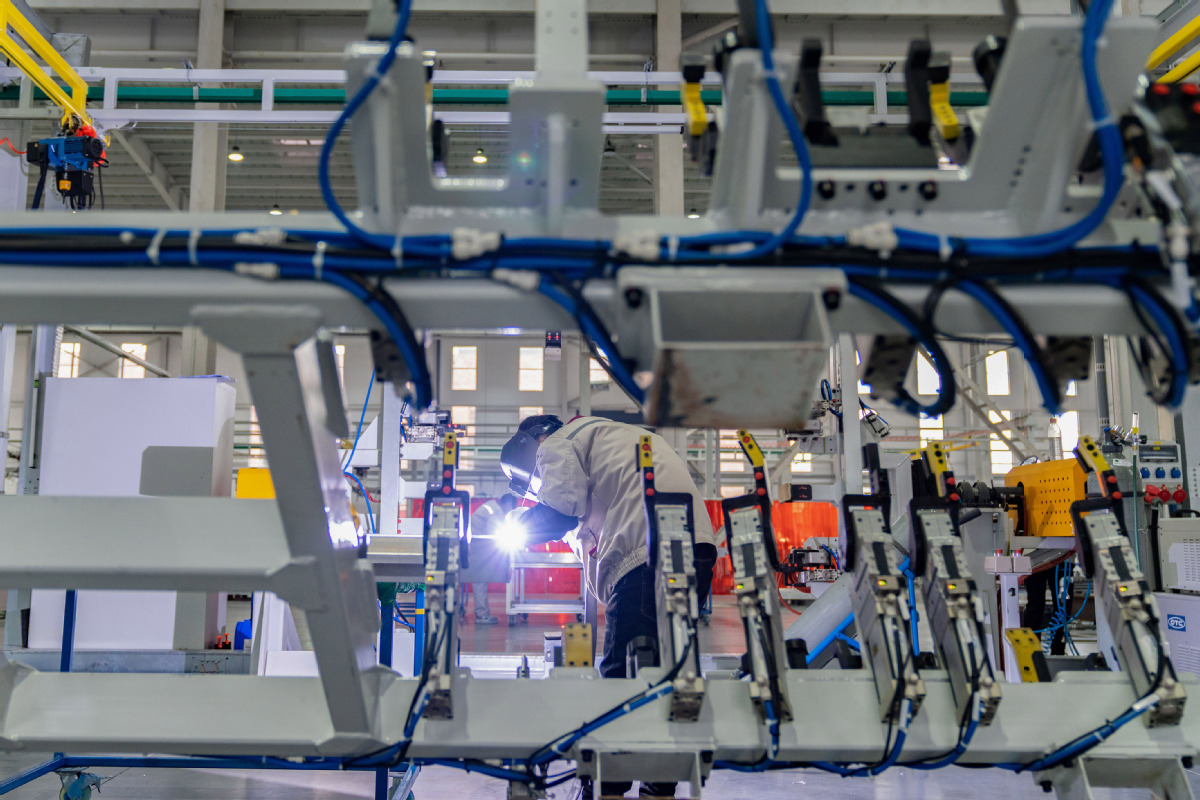

EVE Energy’s Billion-Yuan Base in Shenyang Goes Live

On June 30, EVE Energy inaugurated its system integration factory and cold-region lithium battery R&D center in Shenyang. This is part of a RMB 10 billion investment project initiated in 2022, with mass production slated to begin by mid-2025. The site will support both storage systems and EV battery development.

SVOLT Thailand Surpasses 10,000 EV Battery Packs

SVOLT's joint venture plant in Thailand, co-established with Thai conglomerate Arun Plus, marked the rollout of its 10,000th EV battery pack. The facility, equipped with smart logistics and advanced quality control systems, boasts a 99.9% production yield.

Sunwoda Plans Hong Kong IPO to Drive Global Strategy

On July 1, battery manufacturer Sunwoda revealed plans for an H-share IPO in Hong Kong to enhance its global capital presence and competitiveness. In 2024, Sunwoda's global power battery installation volume reached 18.8 GWh—a 74.1% year-on-year increase.

CATL’s Multi-Base Expansion and Strategic Moves

CATL reported major developments across its sites:

- Its Luoyang base aims to start Phase II production by September, while Phase IV will break ground soon.

- In Chongqing, the firm launched two advanced battery production lines using its CTP 2.0 tech to serve AITO models through a “factory-in-factory” approach.

- In Hainan, CATL launched five new battery swapping stations, including “Chocolate” and “Qiji” types, supporting electric heavy-duty truck operations at key ports.

Global Partnerships and Overseas Investments Multiply

- EVE Energy also submitted a Hong Kong IPO application to fund projects in Hungary (30 GWh cylindrical battery capacity) and Malaysia (38 GWh storage battery project).

- Ronbay Technology partnered with Rock Tech Lithium to establish an integrated cathode supply chain in Europe.

- Farasis Energy and European partners are advancing LFP battery recycling technologies.

- CATL’s Indonesian JV commenced construction on a plant with an initial 6.9 GWh capacity, expandable to 15 GWh.

Solid-State & Sodium Battery Innovations Gain Momentum

- Enjie established a new subsidiary in Yunnan for sulfide-based solid-state electrolytes.

- Far East Battery won major storage contracts in Shandong and Europe.

- Ganfeng Lithium completed a $343 million acquisition of Mali Lithium, securing full ownership of the 51,000-ton Goulamina spodumene mine.

- Ningde Times and other firms are fast-tracking sodium battery deployments, with pilot lines and grid-scale projects already underway in Zhejiang and Inner Mongolia.

Strategic Collaborations & High-Profile Orders

- CALB passed rigorous equipment validation tests from a top Korean customer for its 46-series laser winding machines.

- Nandu Power secured a 1.4 GWh order for a major storage project in India—the country's largest single-unit ESS order to date.

- Xinwangda continues its IPO journey as it builds market share in EV batteries.

Noteworthy Highlights from Across the Value Chain

- Tinci Materials, Cangzhou Mingzhu, and Zhenhua New Material report solid progress in solid-state electrolyte and high-energy-density material development.

- Grafintec Oy in Finland secured land for a graphite anode facility, deepening Europe’s upstream battery material capabilities.

- Tesla announced that its first LFP battery factory in North America is nearing completion, with core equipment supplied by CATL.

- Haibo Sunchuang signed a strategic MoU to supply 5,000 integrated charging-storage units to Alpina across Southeast Asia by 2027.

From IPOs and giga-factories to cutting-edge solid-state and sodium-ion technologies, China's new energy companies are rapidly expanding their global footprint while innovating across the battery value chain. These developments mark a new phase in the energy transition landscape, positioning Chinese firms as frontrunners in the race to electrify the future.

Location >>

Location >>